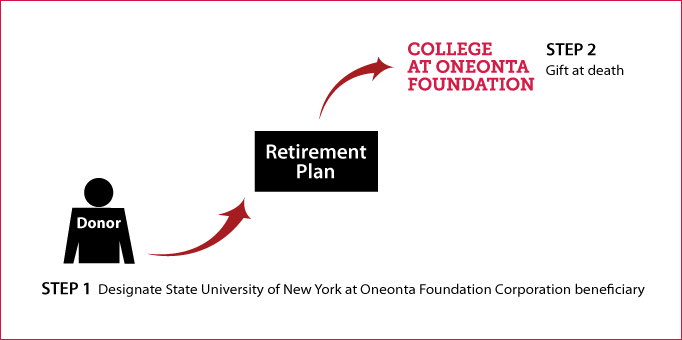

Gifts from Retirement Plans at Death

How It Works

- You name State University of New York at Oneonta Foundation Corporation as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to State University of New York at Oneonta Foundation Corporation

- No federal estate tax on the funds

- You make a significant gift for the programs you support at SUNY Oneonta

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Jill Mirabito |

SUNY Oneonta |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer